Pitchbook has released venture capital investment data for the various economic areas, with good performance in Europe, while the rest of the world shows mixed trends.

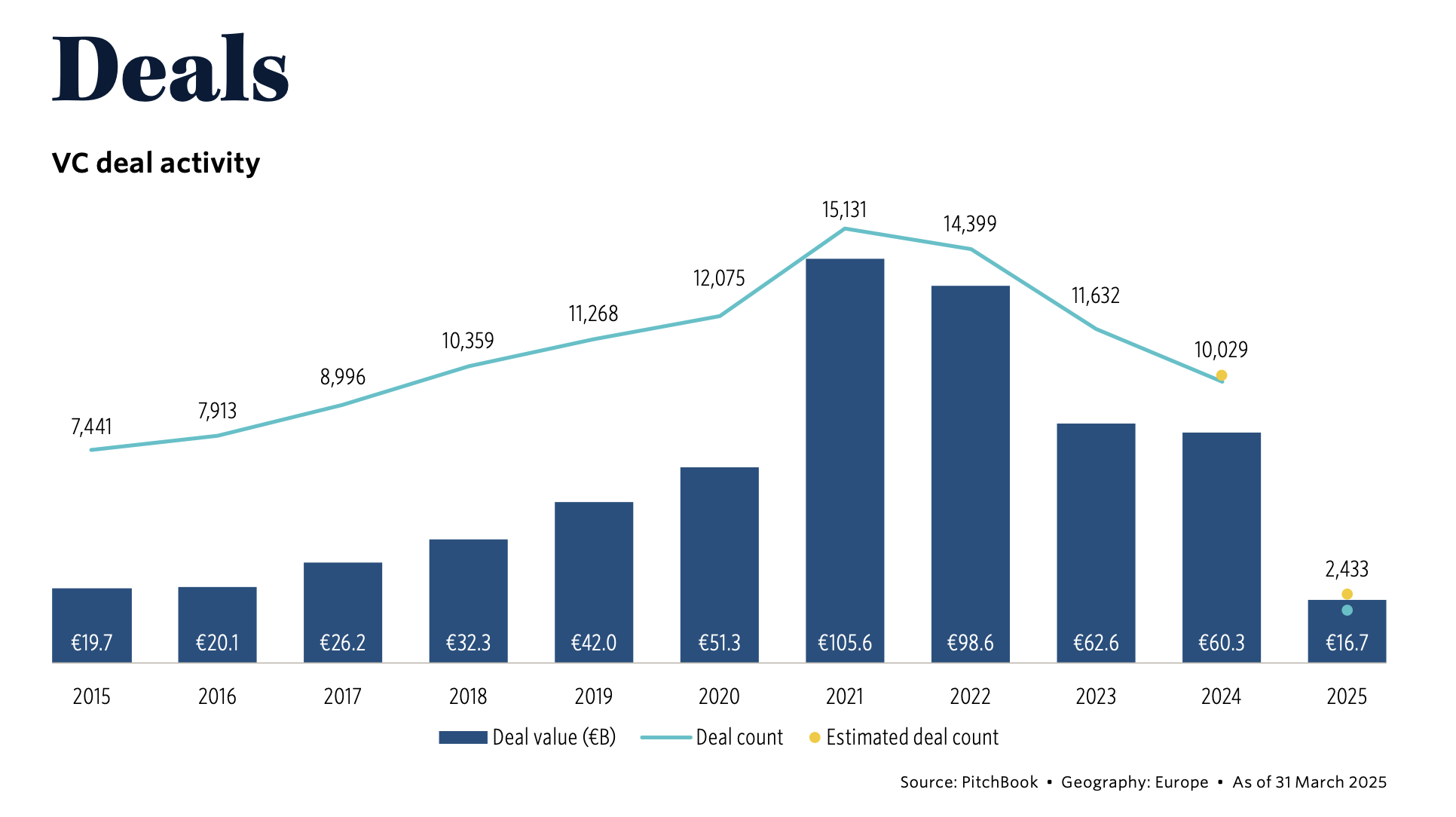

The value of venture capital deals in Europe grew in Q1 2025, despite a cautious start to the year. Activity in European venture markets reflects the cautious sentiment in the global macroeconomy, with volatility and uncertainty increasing in Q1 2025.

In terms of transaction value, venture growth showed the greatest resilience in VC-type investments, i.e. the later-stage ones, while the value of pre-seed/seeded transactions declined the most.

AI and machine learning took the top spot in transaction value in Q1, surpassing software as a service (SaaS) for the first time. Compared to 2024 activity, fintech showed the greatest resilience.

Among the European regions, France and Benelux had the lowest percentage in terms of transaction value.

The value of venture debt transactions is below the 2024 record. In the first quarter, venture-growth companies increased their lead in the share of venture debt deals, with almost 50 per cent of deals.

Exits got off to a soft start. The value of exits in Q1 2025 is lower than last year. Q1 activity may not be a reliable barometer for the rest of the year, where we expect the momentum of exit activity to be driven by (and concentrated in) a few large transactions. However, tariff escalation and volatility will weigh on activity, with several traders stating that volatile conditions are affecting their exit decisions.

“Transaction value in Q1 2025 stood at EUR 16.7 billion, a growth rate equal to a 10.8 per cent year-on-year increase in transaction value for the full year,” says Navina Rajan, EMEA senior private capital analyst at Pitchbook

Rest of the World

Venture capital acquisition activity in Asia Pacific remained subdued in Q1 2025, continuing a multi-year trend of caution due to macroeconomic uncertainty. The number of deals declined, but total capital invested increased significantly, driven by larger rounds in the B2B sector. Binance raised USD 2 billion, which was the largest deal in Asia. VC-backed exit activity continued to lag behind in Asia, falling to just 95 exits in Q1 2025, the lowest since Q2 2019. The dearth of exits also had an impact on fundraising, which remained muted pending clearer signs of liquidity.

ICT technology remains the leading sector by number of transactions, supported by the development of artificial intelligence and digital infrastructure. This trend has also been supported by government-led strategic initiatives, especially as geopolitical tensions continue to drive the push for technological sovereignty in the more developed countries of Asia.

“South Korea, for example, launched a KRW 34 trillion (around EUR 21 billion) fund in February to support cutting-edge industries such as semiconductors, batteries and biotechnology. In March, China also announced a state-led VC fund to support advanced manufacturing and strategic technologies,’ adds Melanie Tng, Asia Pacific private capital analyst.

The US market is almost doubled with a handful of companies able to raise huge amounts of money, and the rest of the market still struggling with a lack of capital. 71% of the total value of transactions in the US went to investments in AI. This value is

heavily influenced by OpenAI’s $40 billion round. Even excluding this deal, AI still captured 48.5% of the total invested in the quarter on one-third of completed deals. Exit activity showed signs of picking up with the IPO of CoreWeave, the announcement of a $32bn acquisition of Wiz (not yet completed) and several other IPOs.

“However, outside of these few transactions, the liquidity market has remained subdued. Only 12 companies have completed IPOs and there is no shortage of liquidity concerns,” explains Kyle Stanford, director of US Venture Research

Venture capital investments in Latin America reached USD 1.4 billion in the first quarter, the strongest quarter by deal value since the third quarter of 2022. Several large deals weighed on the total, including a $376m investment in digital banking app Ualá. The number of transactions decreased by around 20% compared to the previous quarter, and was at its lowest level since 2020

ALL RIGHTS RESERVED ©